Bitcoin crashed around 50% in just 10 hours sparking contagion fears in the markets. Bitcoin has been on a roller coaster ride for the past few months. Don’t know how bitcoin works, read this post that explains how bitcoin work. BTC price increased so rapidly that many analysts started calling it a bubble that will be remembered in history just like the stock market crash of 1929. In this post I plan to discuss in detail the future of bitcoin and what can we expect. But first let’s take a look at the BTC/USD charts. I am a trader and not an investor. I don’t believe in buy and hold. I have no long term investing horizon. I am basically a market timer. Market timing is what works and that’s what I do. Take a look at the following BTCUSD H4 chart first!

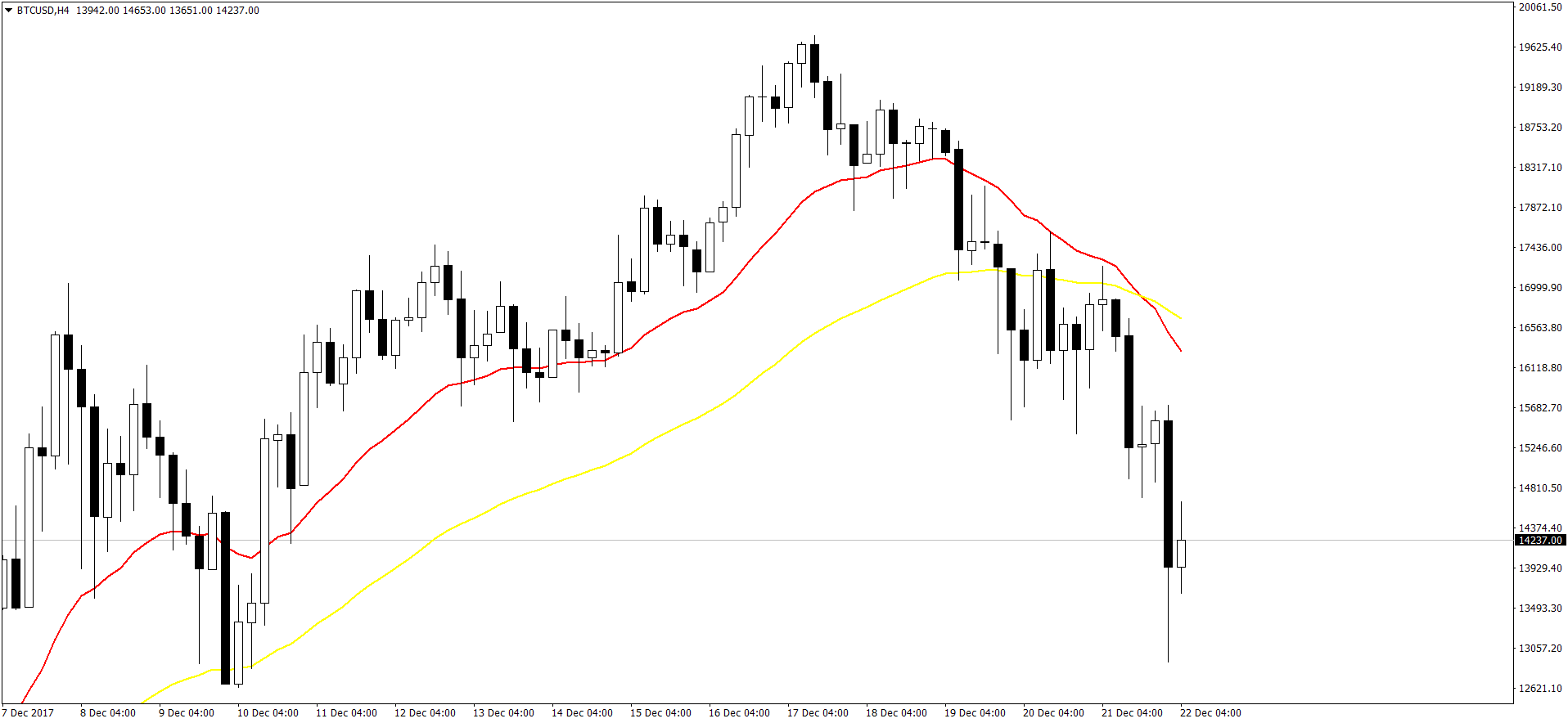

This happened on Friday. Fridays are always full of surprises for the traders. On Friday you can find prices going up all of a sudden or falling down and crashing so always watch each Friday with concern and trepidation. In the above BTCUSD 4 hour chart you can see BTCUSD price falling from around $19K to the low of $10K before making a recovery. Now as traders we are fond of using technical analysis. Do you know this fact that technical analysis is a universal method and works for all sorts of markets where we can record prices over fixed intervals of time like intraday, daily, weekly and monthly. If you look at the above chart you can easily predict that price is planning to do down well before it actually went down. So trading bitcoins is no different than trading stocks, currencies or commodities. Look at the above chart. Last candle appears to be bullish. Keep this in mind, the candle has not closed yet. Now check this chart below that shows price after 8 hours!

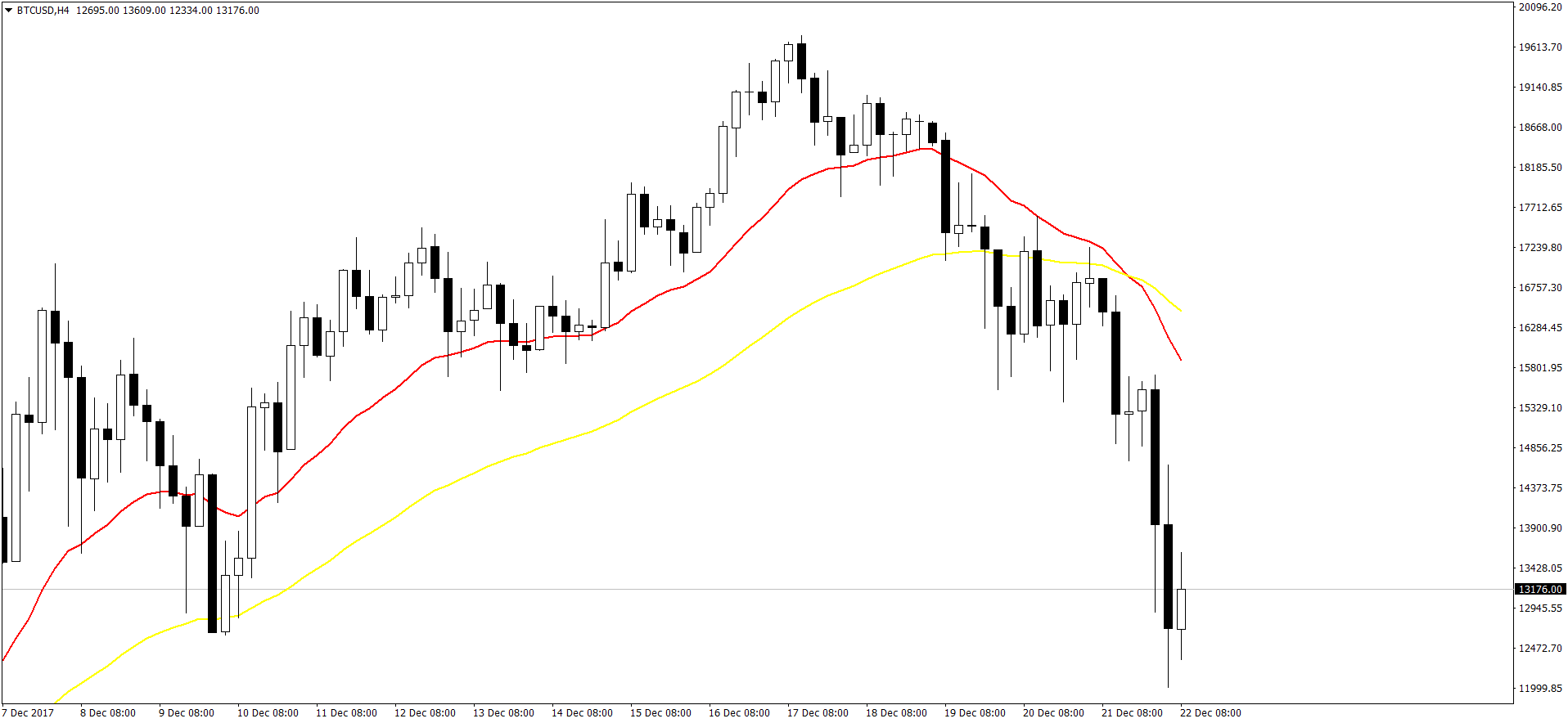

The bullish candle that you saw in the first chart actually closed as a bearish candle as you can see in the above chart. Price went down as low as $11K before it rebounded it seems. Now check the chart below that shows price after 8 hours again. Once again price crashed and this time it touched $10K before bulls started to move price up. This time you can also see the MACD indicator in the chart. MACD is a pretty solid momentum indicator. It is saying down momentum is strong. This means price will go down more. Market has closed for the Christmas holidays. When it opens next week, you can expect BTCUSD price to go down more. A hedge fund manager is of the opinion that price can go as low as $8K next week. Can you see the doji candle in the chart below, this could have been a great entry for a sell trade.

If you read my Investing 2.0 blog, you know I am a firm believer in keeping the risk as low as possible. If you had used the above doji candle for a sell entry your stop loss would have been just $10. Of course you need to add the spread as well which can be as much as $400. So your total risk would have been around $500 and you could have bought around 6 bitcoins against one standard lot. Place the stop loss around $12K and you could have easily made $8K per coin or a total of $48K in just one day with a small risk of $500. Below you can see BTCUSD daily chart!

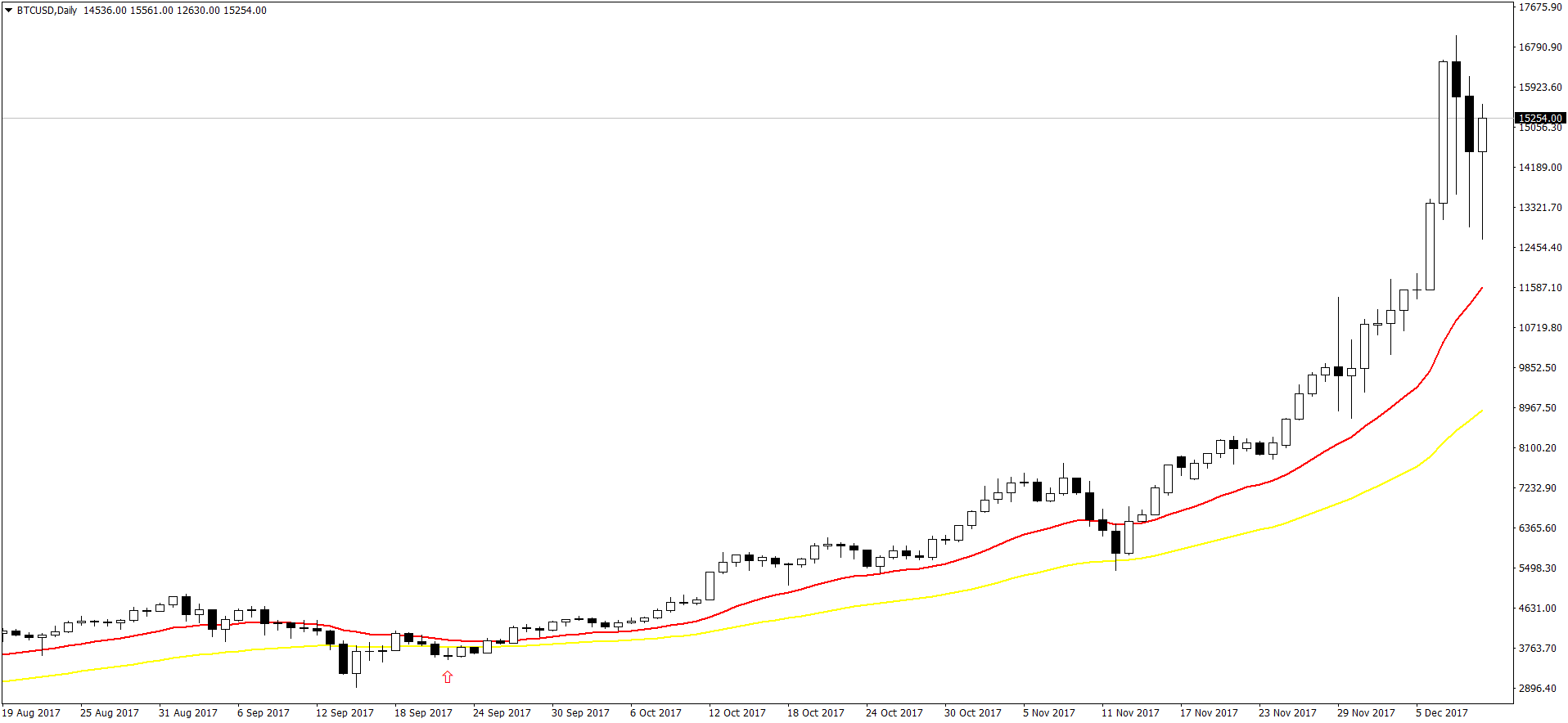

Looking at the above daily chart, you can see BTCUSD prices rising and rising. The red arrow shows a low risk entry for the buy trade that could have made you around $200K in just 2 months. Instead of investing in bitcoins, market timing them by buying and selling them can make you a good profit if you know how to do it. Of course, you can misread the charts and lose the trade. This always happens. That’s why we always try to keep risk as low as possible.

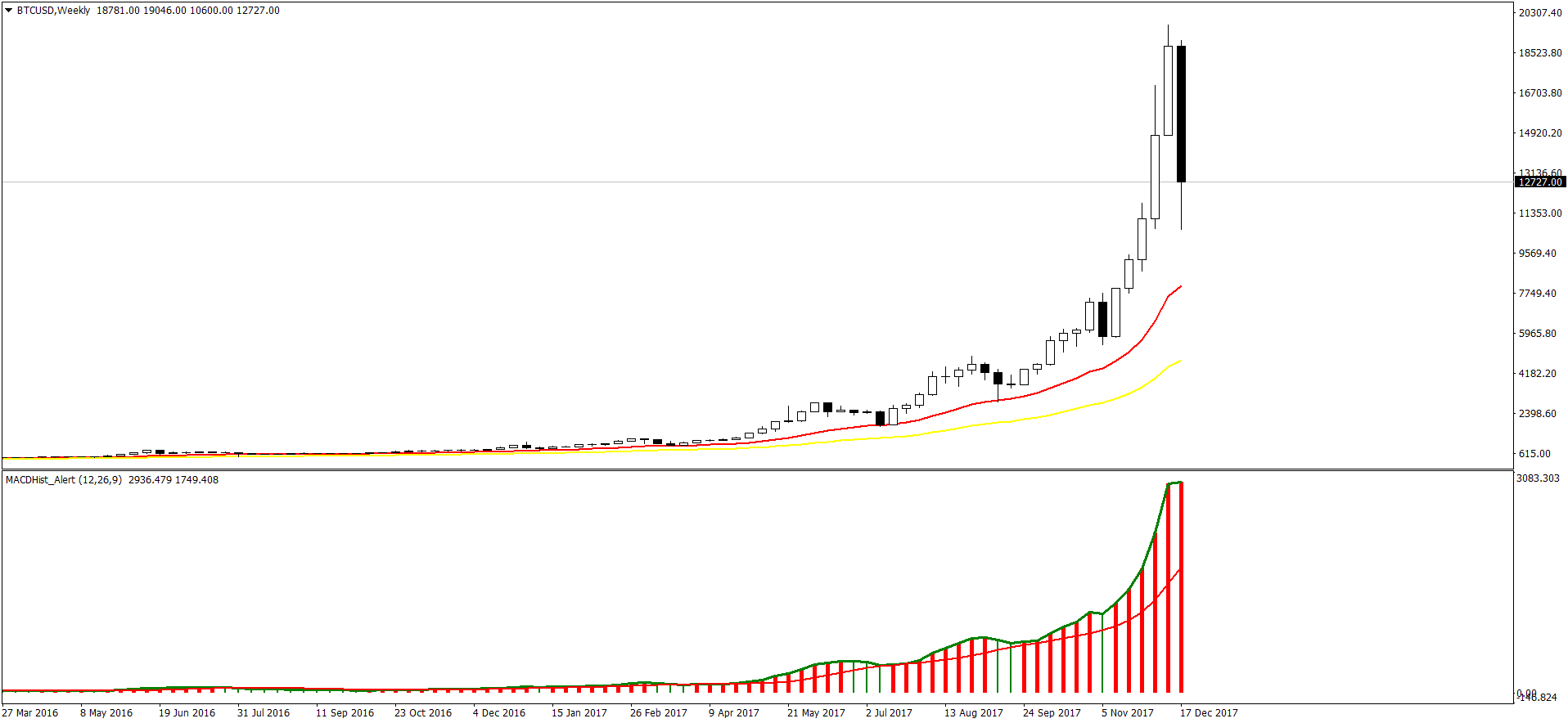

Above you can see BTCUSD weekly chart. Last weekly candle was very bullish so looking at the weekly chart, you have no clue price will fall like a stone this week. However looking at lower timeframe chart of H4, we can figure out much earlier that price is crashing. So it is always a good thing to look at the higher timeframe charts and then look at the lower timeframe chart. This gives you a holistic picture of what is happening in the market. So what happened that BTCUSD fell down like a stone 50% in just one day, you might be wondering. Understanding market psychology is always a good idea. This what I think happened. Just before the Christmas holidays majority of the buyers decided to take profit and make their Christmas and the New Year really memorable with all the money in the their pockets. Prices are down now. Next year, you will find these buyers returning with new enthusiasm and injecting new zest in the market. There are some analysts who are forecasting $400K by the end of the year.

Keep this in mind big transactions fees a big problem right now with bitcoins. A journalist recently tweeted that he had to pay $15 to transfer $100 from the digital wallet to a hardware wallet. On average people are paying around $28 to make transaction with the digital currency. Some three weeks back, BTCUSD had suffered a 15% loss in prices when Coinbase a big cryptocurrency exchange announced rolling out support for Bitcoin Cash a rival cryptocurrency. Investors started buying Bitcoin Cash causing BTCUSD prices to crash 15%. But the crash that happened on Friday took almost all the cryptocurrencies down. All suffered huge loss in value. There are some 1000 investors who hold around 40% of the bitcoins that have been mined. They are known as Bitcoin Billionaires. These people have shown interest in taking profit a few weeks back. So we can assume they had taken part in the selling that took place on Friday.

CNBC reported last week that one of the early bitcoin investors Dan Morehead who had bought BTCUSD at $72 predicted last week before Friday that BTCUSD will lose around 50% of its value before it rebounds and goes much higher than $20K. According to Dan Morehead, cryptocurrencies are a multi decade thing and not going anywhere. There will be ups and downs. This is just the start and we can see these cryptocurrencies going very high. Another interesting fact from CNBC. James Howells an IT professional living in UK started mining bitcoins in 2009. In those days, mining was an easy thing which could be done on a personal laptop. Now you cannot do that as mining as become a highly specialized operation. You need decided GPUs alongwith lot of cheap energy to profitably mine bitcoins.

James Howells used his personal laptop to mine something like 7,500 bitcoins around 2010-2013. In 2013 he sold his laptop on ebay. But he kept the hard drive that he had used to mine the bitcoins hoping one day to sell them when price rises. After some months in 2013, he mistakenly put the hard drive in a waste bin. His bitcoins were worth $127 million one day before Friday crash. Hopefully prices will recover and go higher even more. The most important problem for him though is how to find the hard drive that contains all those 7,500 tokens. City Council officials are refusing to allow him to dig the landfill site that most probably has got the hard drive buried in it citing environment as a the reason for refusal.

How Bitcoins And Other Cryptocurrencies Can Reinvent The Financial System

Present financial system primarily revolves around the big banks. Big banks have the power to create money when they issue loans to firms. But when too much loans start circulating in the economy, a small economic shock can cause the economy to tank and with it all those firms that have huge loans on their balance sheets. This is the main cause for the inherent boom and bust cycles in a capitalist economy. Most recent example is that of 2008 financial crash. The major cause for the financial crash of 2008 was the easy mortgage loans that have been provided to every tom dick and harry by the big banks in an effort to make profits. When the real estate prices fell, all those people stopped their mortgage payments and this ultimately led to the collapse of a number of big banks and then the financial crisis of 2008. Do you know who was Satoshi Nakamoto? Read this post on Satoshi Nakamoto an unknown person who invented bitcoins. Identity of Satoshi Nakamoto is mystery even today. Aussie computer scientist Dr. Craig Wright claimed that he was Satoshi Nakomoto in a press conference at the start of this year.Satoshi Nakamoto was the first miner and he is supposed to own 1 million bitcoins valued around $15 billion as of today. Today it does not matter who was Satoshi Nakamoto as bitcoin has developed a momentum of its own.

Coming back to our main topic, right now there are the Central Banks who are the most important players in the global financial system. Governments have ceded control of the monetary policy to their Central Banks who are controlled by a group of bureaucrats also known as the central bankers. Famous central banks in the world are the Federal Reserve System, Bank of England, European Central Bank, Bank of Japan and so on. In the recent financial crisis, these central banks simply ignored the ordinary people who had small deposits in their accounts and instead focused on the big banks and made an all out effort to save them. The reason given was that these big banks have the potential to bringing down the global financial system with them if they fail so they must not fail. So almost all these central banks made interest rates almost zero and even made interest rates negative in order to help these big banks. Imagine paying interest rate to the banks on your deposits this is what negative interest rates mean practically. Lot of money was printed by these central banks. This cheap money is now flooding the global economy and has the potential of causing inflation. In nutshell this is what is happening. Central Banks have their own selfish agendas. These central banks mostly cater to big businesses and try hard to protect their interest while ignoring the ordinary people.

Enter the new players in the town: Cryptocurrencies. Bitcoin was the first cryptocurrency. Bitcoin and all these cryptocurrencies are peer to peer distributed computer networks that are decentralized meaning nobody can control them. At the heart of these distributed peer to peer (P2P) networks is the distributed ledger also known as the Blockchain. These blockchains have the potential to revolutionize the global financial system. Emergence of these cryptocurrencies means new currencies circulating the global financial system competing with the established currencies like the US Dollar, EURO, British Pound, Japanese Yen and so on. The good thing these cryptocurrencies are not controlled by a central authority so we have more democratization in the global financial system. Over the long run if this new experiment succeeds and cryptocurrencies manage to survive, we will have more democratic global financial system with a lot of less risk as compared to today and less dominance of US Dollar. So in the long run, we can expect these digital currencies to break the stranglehold of the central banks and the big banks on the global financial system by democratizing the global financial system.

Central banks in a centralized system make all the decisions mostly based on the data gathered from the economy and the experience of the central banks who are running the show. However, in cryptocurrencies like bitcoin, centralized decision making is simply not possible. At the start, the original inventor Satoshi Nakamoto made certain decisions at the design phase that he incorporated into the P2P software. The most important decision that he took was that only 21 million bitcoins can be mined. New bitcoins can only be mined at a planned schedule. Making change to these decisions that Satoshi Nakamoto took is not easy now as he has build his decision into the P2P software as said above. Unlike the central banks where decision making is central, control in a peer to peer network like bitcoin is subtle. Every change has to be agreed upon by the majority of the peers. If a big minority disagrees with the majority decision it can split and start a new P2P network with its own rules. This is known as hard forking. Forking can be considered as a kill switch that prevents the project being hijacked by some vested interests. Bitcoin has been forked many times by now. This has given rise to many altcoins that incorporated those design changes that were missing in the original bitcoin project. So decision making is not centralized in bitcoin and changing the original design need the consensus of the majority peers in the network. World Economic Forum was the first to feature bitcoin.

Problems With Bitcoins And Possible Solutions

As the first successful digital currency, Bitcoin is an impressive breakthrough though. It has the promise of ultimately developing into an unregulated peer to peer global financial system that brings more democracy to the present opaque system. However, bitcoins have some severe limitations that will overtime haunt this cryptocurrency and become bottlenecks to is future development. The most important limitation is the energy consumption of the mining process. Mining bitcoins requires a lot of energy and leaves a big carbon footprint which is not good for the global environment and can increase the potential of global warming. But mining is important for bitcoins as it is an integral part of its Proof of Work algorithm that validates each transaction. Right now it is estimated that the bitcoin mining is using more energy that that being used in the country Ireland. Bitcoin mining is a huge energy suck. With the rise of bitcoins you can imagine the demand for more energy. An alternative to Proof of Work Algorithm that is now being implemented in altcoins is the Proof of Stake algorithm in which there are a few certified validators who validate each transaction thus using a lot less energy.

Another major problem that bitcoin faces is that it can only only handle 7 transactions in one second. Compare this to around 2,000 transactions that Visa card can handle in one second. So you can see there are some severe bottlenecks that need to be resolved if this digital currency wants to survive in the future. Of course the most important problem right now is the high volatility. As said above in just one day bitcoin lost 50% of its value. This is not the first time this has happened. Bitcoin started the year around $1000 made a plunge down and then went up again. It has happened in the past. Bitcoin prices crashed and then prices roared back with a vengeance making new high. The same is expected this time.

Right now bitcoin prices represent nothing. This is the main cause of volatility. Why I say bitcoin value represents nothing, let me explain. When you buy a stock, theoretically you are buying a small stake in the ownership of the company. This gives you the right to vote in the Board of Directors elections if you own sufficient stocks in the company plus you have a claim on the future dividends issued by the company. When you buy a bond, you have a right on future interest payments plus you get the full repayment on maturity of the bond. In case of bitcoins, there is no obvious thing here. You are not owning any claim on anything. If the price rises you are lucky and can cash in the capital gain. But it can be other way around as well. So in essence bitcoin value represents nothings. You just own a digital token called bitcoin. As there is no reasonable method to value a bitcoin, we find its value highly volatile. Those who bought bitcoins priced $19K must be regretting now or at least hoping for a quick rebound and recovery of the price. Some financial experts have suggested a solution and that is peg its value to some basket of real assets so that its value becomes more stable and can be reliably used as a store of value. Right not bitcoin is not backed by physical goods. Proponents of bitcoins claim this is to be virtue. Maybe it is not a virtue. Gold standard was used for many years as a way to stabilize the global financial system. Later on it was replaced by the Basel Accord which allowed using other assets as a form of backup. Some method will have to be found to make bitcoin values more stable to make it more mainstream. Right now it is too volatile and risky!

Conclusion

In nutshell this is what I think. Bitcoin is an evolving technology that holds promise for the future. Right now it is behaving like a speculative bubble comparable to the Tech Bubble also known as the Dot Com Bubble that wrecked so many small investors around 2000. During the tech bubble internet stocks would double and triple in days. Then everything crashed. So one need to be cautious while investing in bitcoins. As BTC is a new financial technology, it will evolve and it depends how this evolution of technology gets incorporated into the original design of the P2P bitcoin software. Incorporating change in the bitcoin software is not easy as explained above. If the challenges mentioned above gets resolved, BTC has a bright future otherwise it will lose to other cryptocurrencies that have better software design in the long run. Ethereum and Ripple are the two main rivals that have the potential to outsmart bitcoin in the long term. Right now BTC is not a good store of value due to its highly volatility. You cannot use it to issue any loan or mortgage as its value can change 10-20% in matters of hours and those owning that loan or mortgage will be ruined. So there is no danger of bitcoin replacing the established currencies like US Dollar, EURO, British Pound etc. It’s anonymity is now a liability as it has reported being used to trade drugs and pay for crimes. The only thing that is important is the Blockchain technology and big banks and others like the health authorities are still researching and studying how it can help them. Bitcoin is a bubble and it looks almost similar to the Tulip Mania. Some analysts have even called the recent boom a hysteria.The blockchain technology underlying bitcoins is very new and it is being tested now practically in the markets. A lot of things will change over the coming years and it is possible a totally new cryptocurrency emerge from the ashes of Bitcoin.